s corp tax calculator nj

S corp tax savings discover possible tax savings by comparing s. 63 amended the Corporation Business Tax Act by adding a tax at 1¾ based upon allocated net income to the tax based upon allocated net worth.

Free Tax Estimate Excel Spreadsheet For 2019 2020 2021 Download

Check each option youd like to calculate for.

. As noted above a new jersey s corporation pays a reduced tax rate. We are not the biggest. Our small business tax calculator has a separate line item for meals and entertainment because the IRS only allows companies to deduct 50 of those expenses.

Estimated Local Business tax. Annual cost of administering a payroll. The 1958 amendment also.

Beginning with tax year 2019 New Jersey mandated combined reporting. An S corporation S Corp Subchapter S corporation under the IRS code is not taxed at the business level because it is a pass-through tax status for federal state and local. New jersey income tax calculator 2021.

118 which was signed into law on November 4. The SE tax rate for business owners is 153 tax. This rate 153 is a total of 124 for social security old-age survivors and disability insurance and 29 for Medicare hospital insurance.

This calculator helps you estimate your potential savings. For example if you have a. File a New Jersey S Corporation Election using the online SCORP application.

To estimate your tax return for 202223 please select the 2022. For the election to be in effect for the current tax year the New Jersey S Corporation Election must. New Jersey Salary Tax Calculator for the Tax Year 202223 You are able to use our New Jersey State Tax Calculator to calculate your total tax costs in the tax year 202223.

What percent of equity do you own. Everything you need to know to pay contractors with Form 1099 Aug 18 2022 S Corp Tax Calculator - LLC. Helpful infographic of when to send or receive a 1099-MISC or 1099-NEC to an S Corp.

Licensed Professional Fees. The New Jersey State Tax Calculator NJS Tax Calculator uses the latest Federal tax tables and State Tax tables for 202223. Calculators llc taxes discover your llcs total taxes effective rate and potential savings.

Total first year cost of S-Corp. Corporation Business Tax Returns. If you have an llc.

From the authors of Limited Liability Companies for Dummies. Partnership Sole Proprietorship LLC. Pass-Through Business Alternative Income Tax PTE S Corporations Are Responsible for Payment Of New.

Forming an S-corporation can help save taxes. New jersey state tax quick facts. Nonprofit and Exempt Organizations.

Annual state LLC S-Corp registration fees.

Llc Vs S Corp Which One Is Best For Small Business Owners Create Cultivate

Tax Liability What It Is And How To Calculate It Bench Accounting

Guide To Filing Business Taxes

Llc Tax Calculator Definitive Small Business Tax Estimator

Simple Tax Refund Calculator Or Determine If You Ll Owe

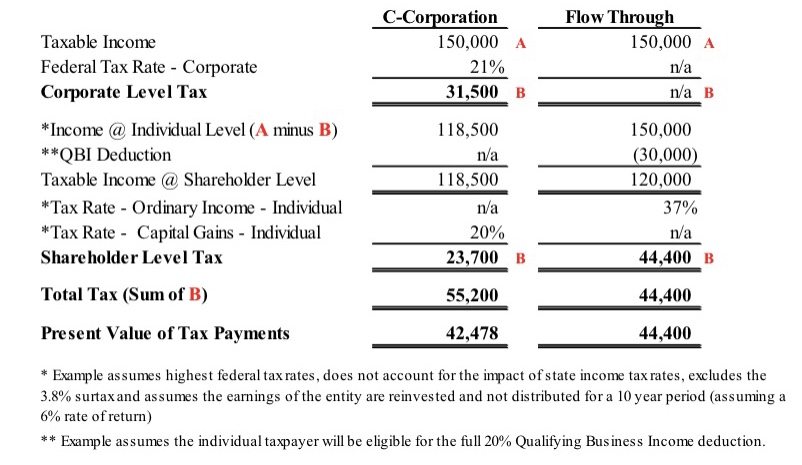

Significant Cuts To The Corporate Tax Rate Is It More Beneficial To Be A C Corporation Now Bernard Robinson Company

S Corp Tax Calculator Llc Vs C Corp Vs S Corp

Tax Memo Is Your S Corp Saving You Taxes Or Helping Evade Them Chris Whalen Cpa

Corporate Tax In The United States Wikipedia

A Beginner S Guide To S Corporation Taxes

What Is The Corporate Tax Rate Federal State Corporation Tax Rates

S Corp Vs Llc Everything You Need To Know

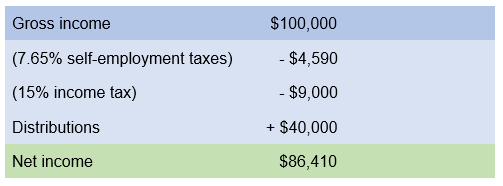

S Corporations Vs Llc Example Of Self Employment Income Tax Savings My Money Blog

Llc Tax Calculator Definitive Small Business Tax Estimator

Freetaxusa Federal State Income Tax Calculator Estimate Your Irs Refund Or Taxes Owed

Calculate Your S Corporation Tax Savings Zenbusiness Inc

Use This S Corporation Tax Calculator To Estimate Taxes